Safeguard Your Home and Liked Ones With Affordable Home Insurance Policy Program

:max_bytes(150000):strip_icc()/dotdash-home-warranty-vs-home-insurance-5081270-Final-b2fa2539ff3c475296bae8529873651f.jpg)

Importance of Affordable Home Insurance Policy

Protecting budget friendly home insurance policy is important for protecting one's home and financial wellness. Home insurance policy provides security against various risks such as fire, theft, all-natural disasters, and personal liability. By having a detailed insurance policy strategy in position, homeowners can feel confident that their most considerable investment is shielded in the event of unpredicted situations.

Economical home insurance policy not only provides economic security however also supplies peace of mind (San Diego Home Insurance). Despite increasing building worths and construction costs, having a cost-efficient insurance coverage guarantees that home owners can conveniently reconstruct or repair their homes without facing substantial financial concerns

In addition, cost effective home insurance can likewise cover individual items within the home, supplying repayment for products damaged or stolen. This coverage expands beyond the physical framework of your home, securing the components that make a house a home.

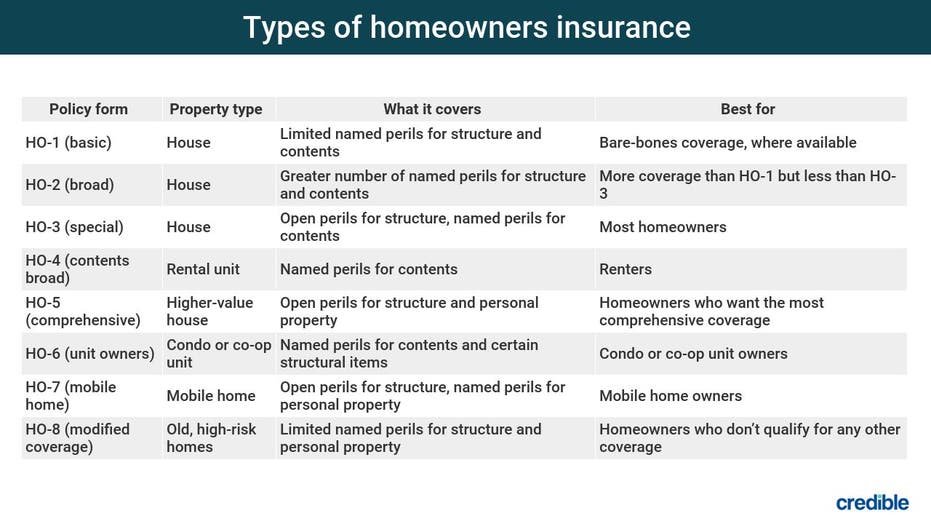

Insurance Coverage Options and Boundaries

When it pertains to protection limits, it's critical to comprehend the maximum amount your plan will pay out for every kind of protection. These limits can differ depending upon the plan and insurance firm, so it's vital to evaluate them meticulously to ensure you have appropriate defense for your home and properties. By comprehending the insurance coverage alternatives and restrictions of your home insurance coverage, you can make educated decisions to guard your home and loved ones effectively.

Variables Impacting Insurance Costs

A number of variables substantially influence the prices of home insurance policy plans. The area of your home plays a critical function in figuring out the insurance coverage costs.

In addition, the kind of insurance coverage you choose index directly affects the expense of your insurance coverage plan. Deciding for additional coverage options such as flooding insurance coverage or earthquake coverage will certainly boost your premium.

Additionally, your credit report, claims history, and the insurance coverage firm you choose can all influence the cost of your home insurance coverage plan. By taking into consideration these elements, you can make informed i was reading this decisions to aid manage your insurance coverage sets you back properly.

Comparing Suppliers and quotes

In enhancement to comparing quotes, it is crucial to assess the track record and financial stability of the insurance policy companies. Search for client evaluations, scores from independent companies, and any kind of background of problems or regulatory actions. A trusted insurance provider ought to have a good performance history of without delay refining cases and supplying superb customer service.

In addition, think about the details insurance coverage attributes provided by each supplier. Some insurance companies may offer additional advantages such as identity theft defense, devices failure coverage, or insurance coverage for high-value things. By very carefully contrasting quotes and companies, you can make a notified decision and pick the home insurance plan that ideal meets your needs.

Tips for Conserving on Home Insurance Coverage

After extensively comparing quotes and providers to discover the most suitable protection for your demands and budget plan, it is prudent to explore reliable strategies for minimizing home insurance. Among one of the most significant ways to minimize home insurance is by packing your plans. Several insurance business offer discount rates if you purchase several policies from them, such as combining your home and auto insurance coverage. Increasing your home's safety and security measures can likewise result in financial savings. Setting up safety systems, smoke alarm, deadbolts, or a sprinkler system can lower the danger of damages or burglary, potentially decreasing your insurance costs. Additionally, maintaining a good credit report can favorably affect your home insurance rates. Insurers often think about credit rating when figuring out premiums, so paying expenses in a timely manner and managing your credit responsibly can result in reduced insurance prices. Finally, regularly assessing and updating your policy to reflect any kind of modifications in your home or scenarios can guarantee you are not paying for coverage you browse around this web-site no longer requirement, aiding you save cash on your home insurance policy premiums.

Verdict

In verdict, guarding your home and enjoyed ones with cost effective home insurance policy is critical. Understanding protection restrictions, aspects, and alternatives affecting insurance coverage expenses can assist you make educated choices. By contrasting quotes and service providers, you can discover the very best plan that fits your requirements and budget plan. Carrying out tips for reducing home insurance can also aid you secure the required defense for your home without breaking the financial institution.

By unraveling the complexities of home insurance policy plans and discovering sensible approaches for protecting economical insurance coverage, you can ensure that your home and liked ones are well-protected.

Home insurance coverage policies generally provide several coverage alternatives to shield your home and valuables - San Diego Home Insurance. By comprehending the coverage alternatives and limitations of your home insurance policy, you can make informed decisions to secure your home and enjoyed ones efficiently

On a regular basis examining and updating your plan to reflect any type of changes in your home or circumstances can guarantee you are not paying for insurance coverage you no longer demand, aiding you save money on your home insurance coverage premiums.

In verdict, safeguarding your home and enjoyed ones with cost effective home insurance is vital.